A key framework of the Organisation for Economic Co-operation and Development (“OECD”), is the Global Forum on Transparency and Exchange of Information for Tax Purposes. The main purpose of such framework is to monitor and review the implementation of international standard of exchange of information on request and automatic exchange of information on administrative and domestic tax laws, where over 160 jurisdictions participate on an equal footing.

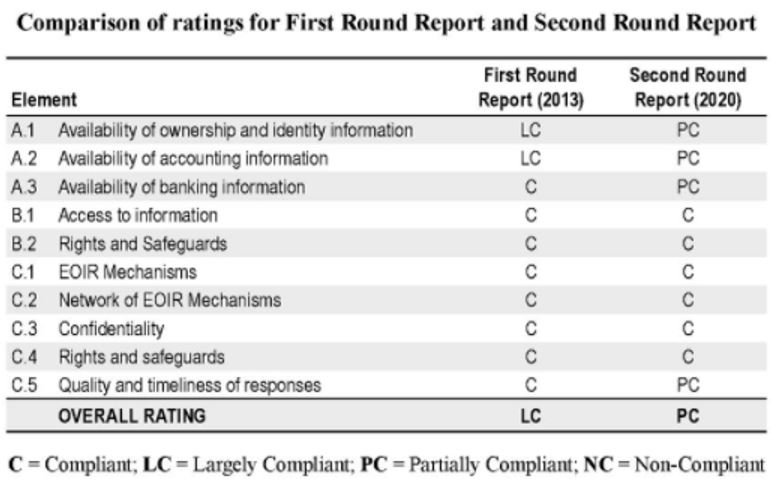

The first round of reviews were conducted from 2010 to 2016, whilst a second round of reviews were introduced in 2016 to ensure continued compliance of international standards. Malta was one of the jurisdictions subject to a review in 2013, and once again in 2020. The assessment was based on three main categories:

(a) availability of ownership, accounting and banking-information;

(b) access to information by the competent authority; and

(c) exchanging information.

From the 2013 assessment, the OECD concluded Malta as Largely Compliant; however such rating was downgraded to Partially Compliant in 2020 due to a downgrade in the country’s

- availability of ownership and identity information;

- availability of accounting information;

- availability of banking information;

- the quality and timeliness of responses, as highlighted below:

One key recommendation raised by the OECD in 2013 referred to the lack of monitoring and supervision to implement a proper framework to make available the ownership and identity information and ensure availability of accounting and banking information. During the 2020 review, the same discussion and analysis was raised.

The 2020 report also outlines a low rate of tax filing by Companies and Partnerships, and by taxpayers in Malta, whilst also highlighting the fact that the Authorities in Malta have not taken the necessary enforcement measures. OECD have highlighted the fact that over 10,000 inactive companies were registered with the Malta Business Registry (“MBR”), had not complied with their filing obligation for more than five years (i.e. 14% of the companies registered with the MBR). Although the MBR confirmed that action had been taken to strike off, the efforts could not be tested by OECD. The OECD also highlighted that 12,351 companies registered with the Commissioner for Revenue (“CfR”) had not complied with their filing obligations for more than five years (i.e. 20% of the companies registered with the CfR).

The OECD also commented on the introduction of the Beneficial Ownership register for relevant entities in Malta, including trusts, which although it is in line with the requirements, enhancement is still required to ensure effectiveness in practice.

The recommendations presented by the OECD is for Malta to enhance its monitoring and supervision functions to ensure that power is sufficiently exercised. It is also being recommended that action is taken to reduce the number of inactive companies. Having concerns on the availability of such information may in practice cause delays to provide the required information.

Source: OECD. (2020 (Second Round)). Peer Review Report on the Exchange of Information on Request – Malta. Global Forum on Transparency and Exchange of Information for Tax Purposes. – https://bit.ly/2DPUBJZ